Table of Content

Colorado residents earning $50,000 can expect to take home almost the exact average for the country as a whole. A flat tax rate of 4.63 percent applies to all workers in the Centennial State, regardless of the amount of income they earn. In the previous tax year, you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability. Federal income tax rates range from 10% up to a top marginal rate of 37%.

You should also fill out a new W-4 anytime you experience life changes, such as a marriage, divorce or the birth of a child. Nebraska’s tax rates hit 6.84 percent for single filers earning $30,420 and joint filers earning double that amount, or $60,840. For Nebraska residents earning $50,000, those taxes are enough to drag their net take-home pay into the bottom half of the country. Mississippi take-home pay rates are just slightly below average on a national basis.

How to Use the Salary Calculator for Canada

New Jersey has one of the highest tax rates in the nation, topping out at 8.97 percent. Even so, New Jersey residents keep more of their income after taxes than the national average. This is possible because the bottom-end tax brackets in the state are low; a joint filer earning $50,000, for example, is only in the 3.5 percent bracket.

Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Social Security taxes will take 6.2% of up to $118,500 of your salary, and Medicare taxes will take another 1.45%, and is applied to your entire salary, no matter how much it is. In English with a Specialization in Business from UCLA, John Csiszar worked in the financial services industry as a registered representative for 18 years. During his time as an advisor, Csiszar managed over $100 million in client assets while providing individualized investment plans for hundreds of clients.

Salary Calculator Canada

Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much you’ll take home. The US Tax Calculator is a great tool for producing detailed tax and salary calculations. State income taxes in Wisconsin are brutal, with a $50,000 earner taking home the 6th-least in the nation after taxes. Both single and joint filers pay 6.27 percent on an income of $50,000, not as bad as the state’s top tax rate of 7.65 percent, but still enough to drag down the state’s net take-home pay figure. Missouri’s top income tax rate of 5.9 percent kicks in after just $9,072 of income for both single and joint filers. The US salary comparison calculator is very popular with jobseekers and those looking to compare salaries in different jobs or different income tax calculations and deductions in different states.

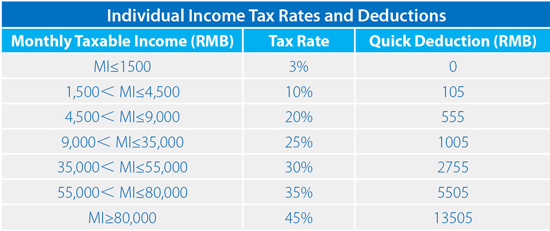

There are further tax brackets with rates of 22%, 24%, 32%, 35%, and 37%. On the high end of the minimum wage, British Columbia pays $15.65 an hour, $626 a week, $2,713 a month, and $32,552 a year. In Ontario and Alberta, that's $15 an hour, $600 a week, $2,600 a month, and $31,200 a year.

New Mexico Income Tax

However, there are times when all you need is a good estimate of the taxes you’ll have to pay on a given salary. Especially graduating students encounter this situation with their first job, but also anyone who switches careers or moves across the country for a new job. While most employees' salaries have taxes deducted from them on payday, if you're self-employed, you need to file a return manually using the government's Revenue Online Service .

The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. Oklahoma’s top state income tax rate of 5 percent applies to incomes of just $7,200 for singles and $12,200 for joint filers. Standard deductions and personal exemptions help lower the overall effective tax rate, but Oklahomans still take home a bit less than the average on a $50,000 income. Minnesota has one of the highest tax rates in the nation, at 9.85 percent. Fortunately, this rate only applies to high earners — single filers making at least $160,020 and joint filers earning at least $266,700.

PAYE

Then, we need to calculate State Income Tax; in this case, it is $0 because the 'State' option in the calculator above is not selected. The total tax-free allowance sum you are entitled to a year equals $12,950. Check the table below for a breakdown of $5,000 a year after tax in the United States.

Some people get monthly paychecks , while some are paid twice a month on set dates and others are paid bi-weekly . The more paychecks you get each year, the smaller each paycheck is, assuming the same salary. For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck.

Of course, for ease of use, our Canadian salary calculator has to make a few assumptions. The most significant is that you aren't married and have no dependents. That means, depending on your circumstances, you may end up paying less in taxes after accounting for your situation and applying credits and deductions. Regardless, this is a good way to approximate what to expect come tax day.

Come tax day, what you owe will look different once these circumstances are taken into account. Wyoming is a great state to live in if you want to take more of your income home, as it”s one of the nine states with state income tax. Residents earning $50,000 can expect to keep $40,963, tied for tops in the nation.

New Hampshire is one of the few states in the nation with no state income tax. Although the state slaps a 5 percent tax rate on interest and dividend income, all wage and salary income is tax-free. This puts New Hampshire into a nine-way tie for the highest take-home pay on an income of $50,000, at $40,963. Middle-income Michigan residents take home about the same as the average American thanks to a flat 4.25 percent state income tax rate.

Washington is one of a few states with no income tax, and there are no cities in the state that have local income taxes either. Washington earners will still have to pay federal income taxes, though. Utah has a simplified state income tax structure, with 5 percent of every dollar earned handed over to the state’s coffers. This flat rate applies to all income, without regard for income level or filing status. This hurts middle-income earners in Utah, as they end up taking home about $640 below the national average. Rhode Island may be the smallest state in the nation, but it stands tall when it comes to taxing its residents.